We make budgets and manage our ongoing daily basis expenses but a sudden and unexpected expense can make us disturbed. To deal with the possible crises we all don’t have savings or money in our future funds.

Most of us deal with these types of situations by selling our precious goods but it takes a lot of courage to sell them. But instead of doing this, you have many other options to borrow money.

If you are facing any financial crisis and finding the best possible way to borrow money then you are at the right place. This article provides you with the best ways to borrow money during a possible crisis.

- Easy Payday Loans

Payday loans are also known as cash advances. Short-term Loans are also fell in payday loans and these types of loans are taken mostly for $500 or even less. These types of loans are very easy to get and are mostly taken to deal with sudden emergencies such as paying medical bills or repairing the car.

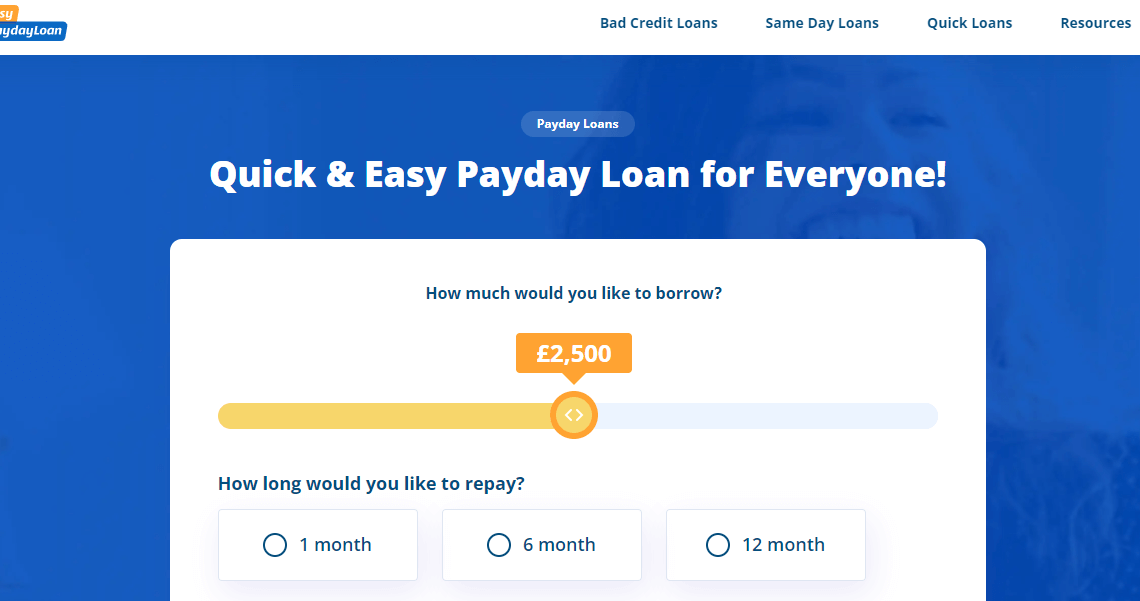

You can easily get a payday loan from any payday lender. Technology has made this easier to get a payday loan.

There are many online websites and services that act as a bridge between industry-leading secure landers and the borrower. EasyPayDayLoan is one of the types of online broker services using which you can get any payday loan within minutes and all you need to do is fill out a simple short online form.

Important features:

- Easy to get

- Provides quick cash

- Helpful in dealing with unexpected emergencies

- Can be gotten by applying online

- Short term ( about two to four weeks)

- Has high APR

- Can be the worst offenders

- Credit Card advance

Credit cards are the most common way of borrowing money. This is also the most expensive way to borrow money. If you borrow an amount from your credit card then you have to pay a transaction fee which is mostly 3 to 5% of the amount you have borrowed from your credit card.

Along with the transaction fee you also have to pay an interest amount. It has been found that credit card rates are recorded as high which are mostly about 17%. And in the credit card advance cash system the rates are even higher, most of the time up to 25%.

Although they are very expensive as compared to other borrowing methods but they can be the best possible option in the bad conditions where you have to deal with the situations on the spot to avoid any disrespectful moment.

It is recommended to avoid credit card advance cash loans if you have other available options. It is also suggested to ask your credit card issuer for a break. As some card agencies allow cardholders to skip a payment for a specific month without incurring interest charges. This will may reduce your repayment amount.

Important features:

- Helpful in avoiding the disrespectful situation

- A most expensive way of borrowing money

- Personal Loans

A personal loan can be taken to deal with any type of situation. You can take a personal loan for the consolidation of a debt/ to cover any emergency expense. This way of borrowing money is cost-effective specially as we compared it with a credit card cash advance loan.

You can contact the landers directly or can apply on an online broker website like EasyPayDayLoan. It will help you to find the best secure lender according to your need and financial situation.

Personal loans are also called unsecured loans and they do not require borrowing money against some valuable thing such as a house. These types of loans are helpful for those who do not have any type of equity. But these loans may come with a higher interest rate if we compared them with a home equity loan.

These types of loans are mostly locked in short terms such as one year to 5 years and the payment is automatically detected from your account. Personal loans are helpful if you want to borrow money more than a credit card cash advance loan and less than a home equity loan.

Important features:

- Can be taken to deal with any type of crisis

- Expensive than home equity loans

- Cheaper than credit card advance cash loans

- Unsecured loans

- Can be taken without the need for any equity

- Short term loans( one year to 5 years)

- Home Equity Loans

Earlier most homeowners use their homes to take loans from the bank. But now the lending standards are quite tight and also the burden of the falling house prices has made home equity loans quite an unsuitable way of borrowing money.

You can take a home equity loan in the form of a lump sum in that situation the rate will be fixed and you can also choose a repayment period from 5 to 15 years or a home equity line of credit with a different rate.

Important features

- Easy to obtain but the debt is also high

- Lower interest rate as compared to other ways

- Possible Text deduction

- Can be a risk of home foreclosure

Things to Consider Before Borrowing Money

Before considering any type of method to borrow money it is important to weigh the possible pros and cons of every source. Following are the things that you must have to consider before borrowing money from anyone:

- Choose the best lender

It is important to do some homework to find out who will lend you money. It is suggested to consider the reputed lenders, if you cant access them then find the best online broker website like EasyPayDayLoan which help you in accessing the industry-leading lenders.

You must have to look for customer reviews, and testimonials and check for the legal credentials of different landers and if you find any type of scam warning then must take it seriously.

- Know the cost of borrowing

From wherever you are borrowing money it is important to understand the loan terms and conditions. You must have to look for the APR and interest rates before applying for the loan.

Don’t be hurry, take your time and consider how much interest you will have to pay during the loan life.

- Make a repayment plan

Before accepting any type of loan you must have to prepare a repayment plan then you will exactly know what are the steps you have to take to make a place of repayment in your budget.

Ending Remarks

A time occurs in our life when we have to borrow money to deal with a possible crisis. It is not shameful and there are many respectful ways of borrowing money. For your better guidance, we have described some of the ways that you should consider borrowing money.